Mind over matter

While many people see incarceration as a setback, O’Brien viewed her time in prison as an opportunity. As she told Money.ca, she framed it as a sabbatical.

“What holds you back in business isn't the equipment or the environment around you, but it's how you choose to react to situations that you're in,” says O’Brien.

O’Brien transformed an obstacle into an opportunity, using her time and resources to build a successful brand.

While watching the 2018 Super Bowl, O’Brien was enjoying the uniquely flavoured popcorn her fellow inmates had created. Inmates would often make their own popcorn flavours with the limited ingredients available to them. They’d use the kernels as a “blank canvas” to explore spice and flavour combinations.

Inspired by the unique flavours, O’Brien used her network of friends outside of prison to conduct market research on the popcorn industry. Ryan Hall — a friend and now a business partner — sent her information on competitors and helped to analyze the viability of her business idea. By July she started up her business, originally called Cons & Kernels. With approval from Correctional Service Canada, operating Cons & Kernels became part of O’Brien’s prison release plan.

By September, O’Brien held her first out-of-prison business event, getting a day-pass to attend. When she was released from custody in December 2018, O’Brien was ready to push her business forward.

What started as a small enterprise that cost less than $100 is now a line of snacks available in about 700 stores throughout Canada, according to O’Brien.

Empower your investments with Qtrade

Discover Qtrade's award-winning platform and take control of your financial future. With user-friendly tools, expert insights, and low fees, investing has never been easier.

Start Trading TodayThe art of starting over

While incarceration might be the lowest time in someone’s life, O’Brien credits her mindset for pushing her toward growth and success.

“After I got arrested so much of what I heard was ‘well your life is over’ and ‘how's it feel to have hit rock bottom?’” says O’Brien.

“There was enough to spark my motivation to prove them wrong.”

While in prison, O’Brien turned to phone calls and letter writing to form a network of business connections. Through the process, she was open and honest about her story and circumstance.

“If you want your business to provide you with meaning and personal satisfaction, it has to connect your past, to your future,” says O’Brien, “no matter how difficult your past might be.”

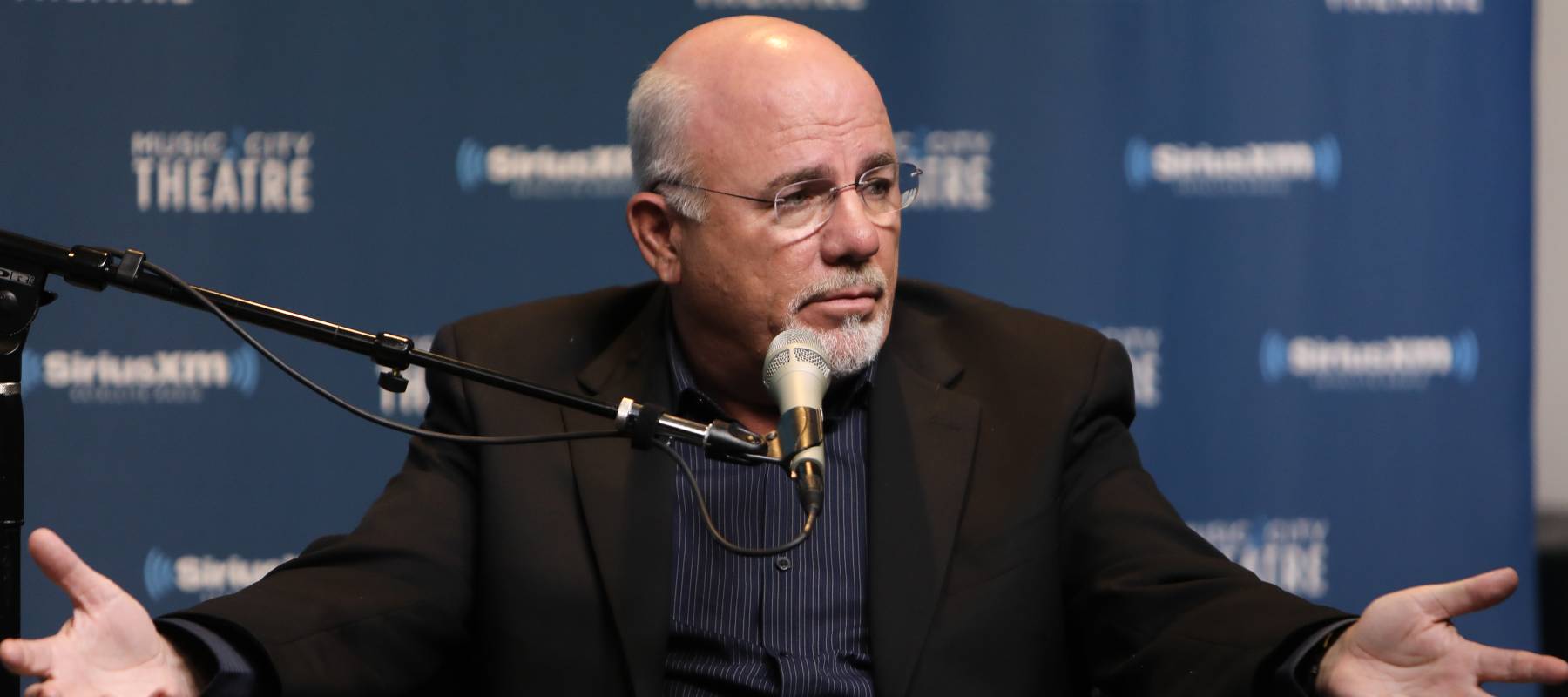

She also took the time to read voraciously and reached out to her idols via snail mail. O’Brien felt the method was more personal and allowed her to stand out more, being “unconventional, yet authentic” as she states on her site. Lawrence Hill responded to her letters and offered to meet upon O’Brien’s release. So did former “Dragons’ Den” panelist and “The Wealthy Barber” author David Chilton.

After reading Chilton’s book, O’Brien wrote an article titled “The Relatively Wealthy Inmate.” Chilton’s assistant read the piece, and Chilton reached out to O’Brien. Since then, Chilton has become a business mentor.

Instead of hiding behind her past, getting people talking about her story helped generate interest in her product, which translated into sales. And with her funneling all she makes back into her business, O’Brien told Money.ca that she still owns 100% of Comeback Snacks and has been able to fund her company without any loans.

Paying it forward

Having full control of Comeback Snacks allows O’Brien and Hall to work with partners and employees of their choosing. This means that she’s able to actively help those in difficult situations.

O’Brien also actively supports rehabilitation and reintegration programs such as the Renascent Foundation and Elizabeth Fry Society.

O’Brien recognizes that there’s some risk involved when hiring former inmates. Individuals may have trauma, or have specific struggles that they’re still overcoming.

Sympathizing with their background and their needs not only creates a positive space for them to re-integrate, but also helps them on a personal level.

“There's a number of places that I've been able to send people, especially small restaurants and cafes. And even just connecting them to education as well has been super important.”

Her company creates a space where the team is able to be open and honest about their personal struggles.

“That actually creates [not] just a sense of healing, but belonging,” says O’Brien.

Unexpected vet bills don’t have to break the bank

Life with pets is unpredictable, but there are ways to prepare for the unexpected.

Fetch Insurance offers coverage for treatment of accidents, illnesses, prescriptions drugs, emergency care and more.

Plus, their optional wellness plan covers things like routine vet trips, grooming and training costs, if you want to give your pet the all-star treatment while you protect your bank account.

Get A QuoteNew look at profit

For O’Brien, regaining your footing after facing a setback comes back to the idea of “emotional profit.”

“That’s a real sense of satisfaction and meaning that our business helps others contribute to the world, and helps us grow and succeed as persons just as much as we help it succeed in the marketplace.”

“Start with what you have and help others do the same. That's emotional profit and that's how you can be truly rich —- without income taxes.”

Trade Smarter, Today

Build your own investment portfolio with the CIBC Investor's Edge online and mobile trading platform and enjoy low commissions. Get 100 free trades and $200 or more cash back until March 31, 2025.