Fairstone review: Get secured and unsecured personal loans

Fact Checked: Scott Birke

Updated: May 10, 2024

- Unsecured loans (up to $25,000), secured loans (up to $50,000) plus debt consolidation loans, home equity loans and retail financing. .

- An easy application process which does not require a hard hit on your credit score

- Higher interest loans than those available through traditional lenders

Choosing to obtain a loan from an online lender, like Fairstone can be a great way to access cash quickly and at an affordable interest rate. That said, if you stray too far from the biggest, most popular lenders in Canada, you may find yourself paying exorbitant fees and interest rates. To avoid landing yourself in a situation where your loan balance seems to only increase instead of decrease, it’s essential to do your research and determine which lenders are right for you. To help you on this quest, here’s our honest review of Fairstone, an alternative lender in Canada.

About Fairstone (formerly Fairstone Financial)

Fairstone calls itself an “alternative lender” and has been offering Canadians personal loans since 1923. When comparing its interest rates to both banks and payday lenders, Fairstone says that it lands somewhere in the middle of the spectrum. Fairstone is a non-bank lender and requires a fair to good credit rating to qualify for their loans. Fairstone has 235 locations across the country, or you can apply for a loan online.

Visit Fairstone LoansTop features of Fairstone

Fairstone offers unsecured loans up to $25,000, secured loans up to $50,000, as well as two mortgage products. Personal loans are paid back over five years, and you can choose from several different payment frequencies. Fairstone lets you apply for your loan online, and offers you a loan amount and interest rate without requiring a hard credit check. You can pay your loan back early without any penalties or fees, and you can “secure” your loan with an asset to access lower interest rates.

Types of Fairstone loans

Fairstone offers three main categories of loans in Canada: personal loans, home equity loans and retail financing.

- 1.

Fairstone's personal loans category includes unsecured loans, secured loans and debt consolidation loans.

- 2.

Fairstone home equity loans use the equity in your home to secure a loan. These include simple home equity loans, second mortgages and mortgage refinancing.

- 3.

Fairstone's retail financing includes point-of-sale financing with partners such as Best Buy, Timber Mart, End of the Roll and several others. This type of financing from is available in store from the partner directly.

Comparing Fairstone Loans: Unsecured Loans vs Secured Loans

Fairstone unsecured loans

The first loan option offered by Fairstone is unsecured, which means Fairstone will use your credit score, income, and other details about your finances to determine whether you qualify.

Fairstone secured loans

The second option is a secured loan, which you use an asset, usually your car or your home, to secure your loan. Since an item of value backs the loan, it is less risky for Fairstone, and you’ll have access to a lower interest rate.

I want to note that for all of these loans, the interest rate is high when compared with other lenders like Borrowell. The higher interest rate makes Fairstone appropriate only if you have a credit score that it too low to use more popular lenders.

Fairstone also offers mortgage refinances and second mortgage loans, but are focusing on their personal loan options.

Fairstone mortgage refinancing

Fairstone will look at your credit history, ability to pay and your home’s value, along with some other features to get you access to available cash to help with home improvements or debt consolidation.

Fairstone second mortgage loans

Get a second mortgage with Fairstone and reset your finances to get closer to achieving your finance goals.

How to apply for a Fairstone loan

Applying for a Fairstone loan can be done in person at one of their 235 locations, or online. If you’re choosing the online option, you’ll be taken through a questionnaire that takes about 10 minutes to complete. There is no obligation to take out the loan, and it will not affect your credit score.

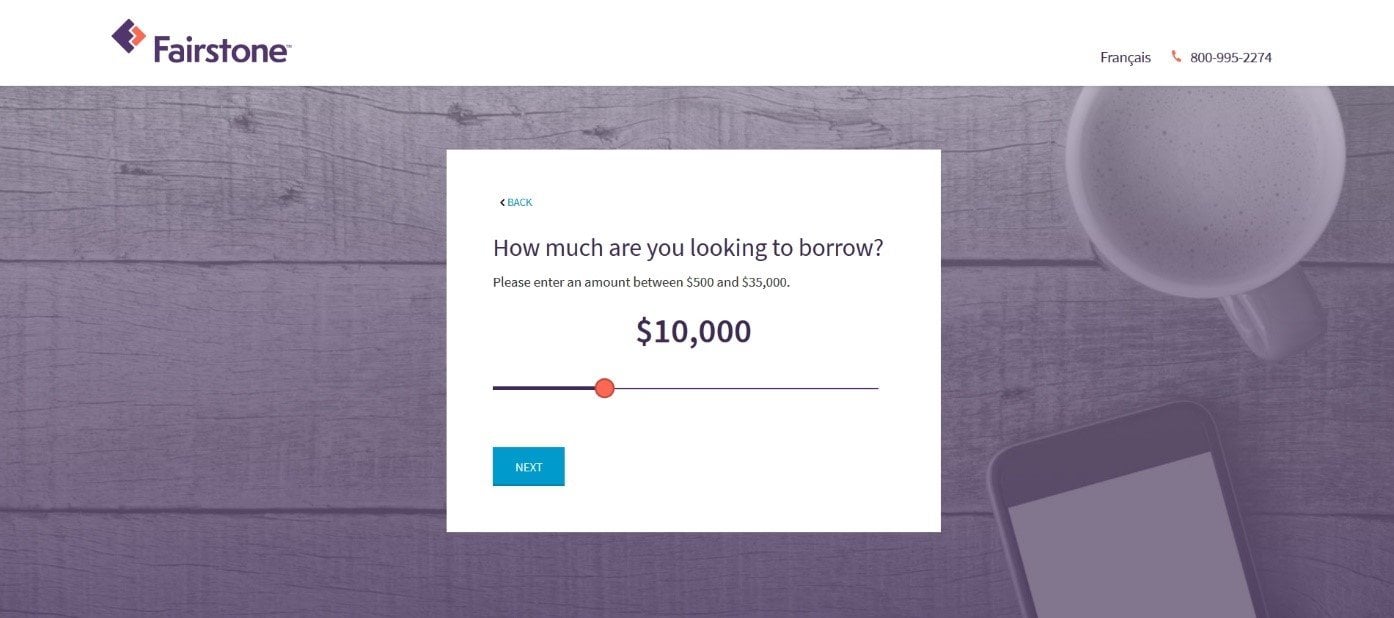

You’ll be able to choose exactly the size of the loan you’re looking for using a sliding scale.

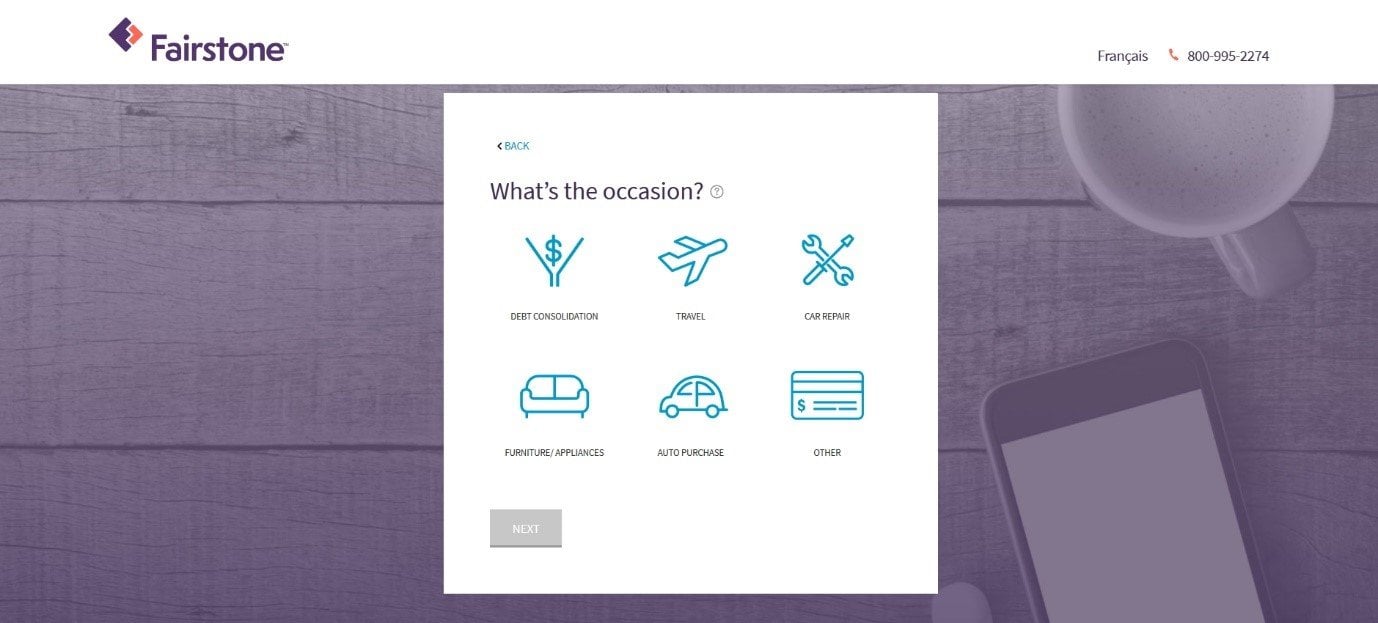

You’ll also be asked for the purpose of the loan. Fairstone says they use this information to customize your loan offer.

Fairstone will collect your details, including:

- Your name

- Your birthdate

- Your address, including whether you rent or own

- Your monthly housing costs

- Your contact information including phone number and email

- Your income

Once your application is complete, you’ll review your information and submit it for approval. You’ll need to permit Fairstone to check your credit score, but this is a soft check and will not lower your score.

It will take a few minutes to process your application, at which point you’ll proceed to the approval page. Once you continue to the approval page, you’ll see your loan offer with instructions on how to proceed if you wish to obtain a loan with Fairstone.

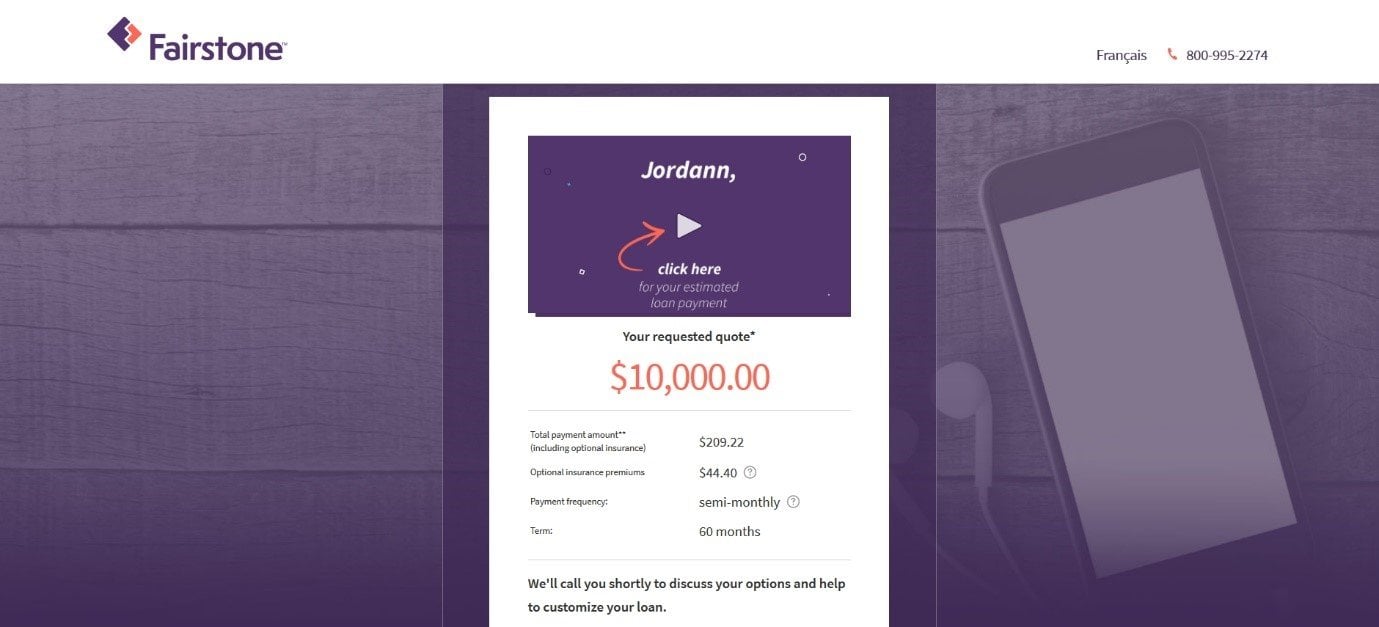

Personally, I applied for $10,000 but was pre-approved for $20,000. It’s not uncommon for lenders to pre-approve you for a higher amount than you requested, but you shouldn’t take on more debt than you need.

The loan I was approved for came with a bi-monthly payment of $209.22 and a loan term of 60 months, for a total monthly cost of $418.44.

It’s worth noting that this quote includes the cost of optional creditor insurance products, which are indicated as $44.40 per payment. Optional creditor insurance can help customers pay off or pay down a loan in case of unforeseen job loss, disability or even death, but are not required to take out the loan.

The actual cost of borrowing would be the quoted payment less creditor insurance, which is $164.82 over a 60-month term.

Interest rates on an unsecured personal loan from Fairstone can be as high as 39.99%, but the exact interest rate you’ll see varies depending on various factors, including your credit score and your province of residence. Keep in mind you can also include optional creditor insurance, which will change your monthly payment.

The table below illustrates how, according to the Fairstone personal loan calculator, your monthly payment for a 5-year, $5,000 loan can change depending on your location and credit score.

What we like about Fairstone

- Various loan amounts depending on your needs, including secured loans

- An easy application process

- Applying does not require a hard hit on your credit score

What we like less about Fairstone

- High interest rates

- A “loan quote” process that doesn’t initially show the interest rate

- A “1.19-star” rating with the Better Business Bureau including 138 complaints lodged in the past 12 months

Numerous online reviews citing difficulty dealing with their customer service team

Who should get a loan with Fairstone?

If you are in dire need of cash and have been turned away by all traditional lenders, the next place you should turn is to your family for a personal loan. If this option is unavailable to you, the unused credit on your credit card is a good next step. If you still need casand you’ve liquidated all of your easy to access assets (investments, cash, and furniture), then perhaps Fairstone could bridge the gap until you get back on your feet.

Who should stay away?

Fairstone offers loans with higher interest rates than prime lenders like banks and credit unions and is, in their own words, somewhere between a prime lender and a payday loan. You should avoid Fairstone if:

- You have good credit that gives you access to prime lenders or other online lenders

- You can use low interest or balance transfer credit cards to solve your cash flow problem instead

- You have friends or family from whom you can seek a personal loan

- You have additional financial resources you could access like non-registered investments, RRSPs, or physical assets like furniture

The final takeaway is that, if you have exhausted your other borrowing options, Fairstone may be a good option for you. Just be sure you understand the math. We break down the numbers below.

How Fairstone compares to other lenders

We’ve compared Fairstone to two other lenders below to see how they stack up.

When it comes to personal loans in Canada, you have several strong options beyond traditional lender like banks and credit unions. Loans Canada is a popular choice, as the company has a good reputation and works with a variety of financial institutions to math you with the best lender for your situation.

If your credit score is not strong enough to qualify for a loan with a traditional lender, Mogo is another reasonable option for online personal loans. They can lend to borrowers with poor credit scores, and offer interest rates starting at a somewhat reasonable 9.9%-46.96% (via their partnership with another lender called Lendful). That said, keep in mind that interest rates at or around the lower end of this range will only be available to those with excellent credit scores; borrowers with low credit scores may be subject to Mogo’s maximum interest rate. It’s important to take these small fluctuations in interest rates seriously because an increase of even a few points can result in hundreds of dollars in added interest charges.

Comparing Fairstone loans

When it comes to borrowing any money, it’s essential to understand the math, specifically how the interest rate and loan period affects your monthly payments and how much interest you’ll pay over the life of the loan. Here are several examples of how much interest you’ll pay for a $15,000 loan using the 31.99% interest rate available from Fairstone to residents of BC, with different time horizons to pay back the loan.

Bottom line on Fairstone Loans

Of the many options for personal loans in Canada, you should only consider Fairstone as an option after exhausting all other resources. The main reason you should hesitate to choose Fairstone is that the interest rates offered by this company are very high.

Get started with FairstoneFairstone FAQs

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.