-1730499575.png)

Justwealth robo advisor review

Money.ca / Money.ca

Updated: November 01, 2024

Justwealth claims to be Canada’s most comprehensive online portfolio platform, and we’re going to do a deep dive into its product offerings to see if that is true.

Justwealth has a host of very experienced staff on their team, from investment managers to marketing pros, and their name Justwealth doesn’t mean “only wealth” but instead refers to “justice wealth” or “fair wealth.” This company makes it its business to take care of your money the way it ought to be cared for – without gouging fees or unnecessary upsells.

My take on Justwealth

Justwealth is a leading Canadian robo-advisor with a reputation for personalized service and strong investment returns. It offers a wide range of portfolios and account types, making it suitable for different investor needs. While it’s not the most visually appealing platform, its focus on financial planning, tax efficiency, and low fees make it a top contender. Let’s explore how Justwealth can fit into your investment strategy.

Justwealth operational details

- Justwealth is a registered portfolio manager for every province in Canada.

- They are headquartered in Toronto, Ontario.

- Their custodian (a fancy term for the financial institution entrusted with safeguarding a client’s assets) is Virtual Brokers, a division of BBS Securities in Canada.

- When you invest your money with Justwealth, your investments are protected by the Canadian Investor Protection Fund, up to a maximum of $1,000,000.

- As a Portfolio Manager, Justwealth must adhere to a fiduciary legal standard (this title is more meaningful than the standard “financial advisor” you’ll see at most banks in Canada).

How Justwealth looks and ease of use

Justwealth’s website has been home to the same bright green and navy blue colour scheme for the past three years. Some say it looks distinguished; I would prefer a sleeker website. That said, the beauty of a website should not affect your choice of robo-advisor. After all, the website is just window dressing.

-1692291111.jpg)

It does seem very easy to use, and it is certainly straightforward to join Justwealth. Just plunk your money in and watch your money grow. That said, an enjoyable user experience will keep users coming back.

User experience and platform overview

The platform is straightforward but not flashy, focusing on clear financial management tools. The new app has received positive reviews, offering basic account management features. The dashboard aggregates all accounts, providing a comprehensive view of your investments.

Who Justwealth is for

Justwealth is best suited for:

- Parents saving for education: Its innovative Education Target Date RESP is perfect for parents who want hands-off education planning.

- Long-term investors: Those looking to grow or preserve wealth over time will benefit from Justwealth’s comprehensive portfolio options and tax-efficient strategies.

- Investors needing personal guidance: A dedicated portfolio manager is assigned to each client, providing personalized advice on financial planning and portfolio management.

Why choose Justwealth?

- Over 70 portfolio options designed to cater to different investment goals

- Personalized service with dedicated financial advisors

- Low fees compared to traditional advisors, with management fees ranging from 0.40% to 0.50%

- Innovative RESP management with target-date funds

Justwealth investment performance

Justwealth’s portfolios have consistently outperformed many competitors due to unbiased ETF selection and strong portfolio management. It offers a solid mix of Canadian, US, international equities, and fixed income ETFs for diversification.

Customer service and support

Each client gets a dedicated portfolio manager, available by phone and email. Justwealth also offers a free portfolio review service for potential customers, providing insights into diversification, fees, and tax efficiency.

Justwealth phone:

Available accounts

Justwealth offers the following account types:

- RRSP (Registered Retirement Savings Plan)

- Spousal RRSP

- TFSA (Tax-Free Savings Account)

- RESP (Registered Education Savings Plan)

- FHSA (First Home Savings Account)

- Non-Registered accounts

- LIRA (Locked-In Retirement Account)

- RRIF (Registered Retirement Income Fund)

- US Dollar accounts

Pros and cons of Justwealth

Pros

-

Extensive portfolio options (over 70)

-

Target-date RESP funds

-

Personalized financial advice and tax-loss harvesting

-

No minimum for RESP or FHSA accounts

-

Strong long-term investment performance

Cons

-

$5,000 minimum investment for most accounts

-

Website design is functional but lacks modern appeal

-

No mobile app

Justwealth fees and costs

- Management Fees: 0.40% to 0.50% of the portfolio value

- ETF MERs: 0.15% to 0.25%

- Minimum Account Fees: $4.99/month for accounts under $12,000

- RESP Fee: $2.50/month for accounts under $25,000; $500 setup fee

Like many robo-advisors, Justwealth’s cost structure is easy to understand, and there are only two fee options. For those with less than $500,000 invested, the management fee is 0.50%. If you have more than $500,000 invested, your management fee is 0.40%. Simple! These fees cover all trading, custody and annual account fees. For accounts of less than $12,000, there is a minimum account fee of $4.99 per month. The minimum amount you need to open an account with Justwealth is $5,000, which is a little higher than some other robo-advisors in Canada.

If you are opening an RESP, the structure is a little bit different: they are only subject to a $2.50 per month fee for accounts smaller than $25,000, and there is no minimum account size.

How robo-advisors work

Just like other robo advisors in Canada, instead of visiting a financial institution (e.g. Big Canadian Bank), speaking to a mutual fund sales representative (aka financial advisor), and then linking to the bank’s head office, you can go directly to Justwealth and sort out your whole portfolio quickly and efficiently.

Because you are cutting out the middle person, the fees on your portfolio are much lower than the traditional Canadian management expense ratio fee of 2.5%.

As they show, 2.5% over many years erodes your retirement money by a massive amount.

Keeping your investing fees low is key to growing your wealth. After you put your money into a Justwealth account and input your data (e.g. investment goals, age, etc.) the Personal Portfolio Manager will provide you with a portfolio that suits you perfectly.

Right now, Justwealth offers 70 different portfolio options – by far the most of any robo-advisor. The portfolios are made up of 42 ETFs from 9 different ETF providers. Unlike other robo-advisors that only have a handful of options and choose the portfolio that most closely meets your needs (which may not be that close), Justwealth offers portfolios for literally every age and risk tolerance. Whether you are looking for portfolios for your taxable investments or your child’s RESP, or you are investing your very first dollar into your TFSA, Justwealth has an option for you.

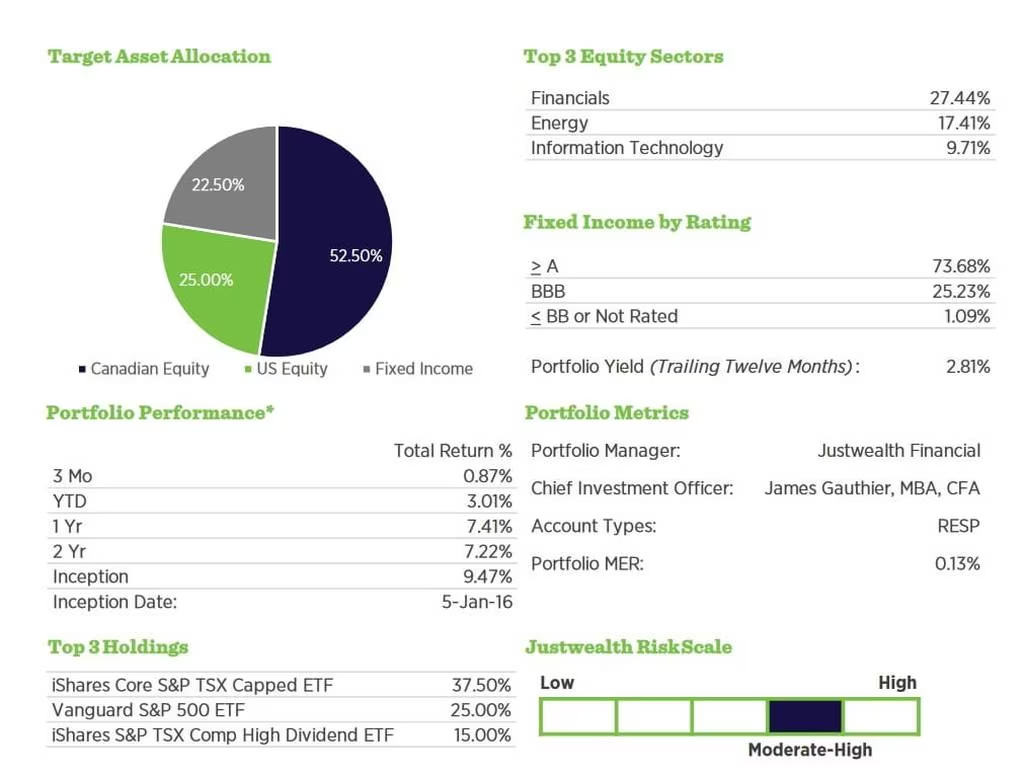

A unique example of the niche portfolios that Justwealth offers is the Education Target Date portfolios. These portfolios are designed to automatically rebalance as the target date approaches, so that when your child graduates, their money is available. As you can see in the screenshot below (taken from the “Performance” section of the website), the makeup of the portfolios is available without ever creating an account, allowing you to browse for the best portfolios without committing.

For example, with a target date of 2030, we see that the bulk of the portfolio is made up of iShares and Vanguard ETFs.

Type of accounts

Justwealth offers the standard account types we’ve come to expect from robo-advisors, including:

- RRSP (Registered Retirement Savings Plan)

- Spousal RRSP

- Non-Registered Account

- RESP (Registered Educational Savings Plan)

- Locked In Retirement Account

- Life Income Fund

- RRIF (Registered Retirement Income Fund)

- TFSA (Tax-Free Savings Account)

What makes Justwealth unique

- You can open a US Dollar account for some of their accounts including non-registered, RESP, TFSA, RRSP and spousal RRSP. A USD investment account is ideal for anyone with excess USD.

- For accounts larger than $1,000,000 Justwealth will prepare a custom portfolio for you.

- Every Justwealth customer is assigned a Personal Portfolio Manager who will review your finances beyond your portfolio and recommend the best portfolio for you. Additional financial planning and investment counselling are available upon request.

- Justwealth offers over 70 different portfolios for their customers, and each customer is assigned a personal portfolio manager who will help you choose the right portfolio or portfolios for your investment.

- Justwealth offers Education Target Date Portfolios for RESP accounts and is the only Portfolio Manager in Canada (online or traditional) with an investment that automatically rebalances and matures as the target date for the child’s post-secondary education approaches. Simply choose the target date, and your child’s money will be ready when they need it most.

- Justwealth does not receive any kickbacks from exchange-traded fund companies, nor do they have a preference for particular exchange-traded fund companies.

A peek inside Justwealth

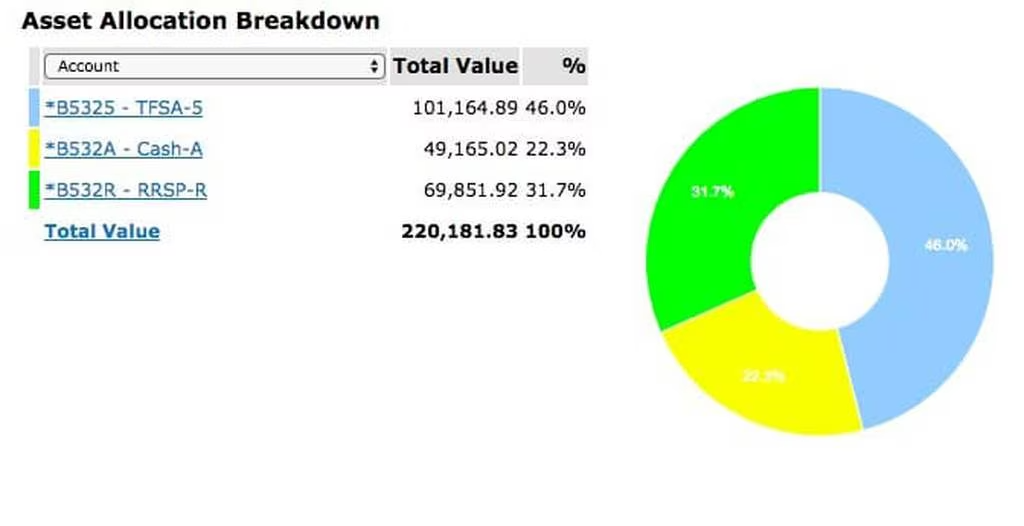

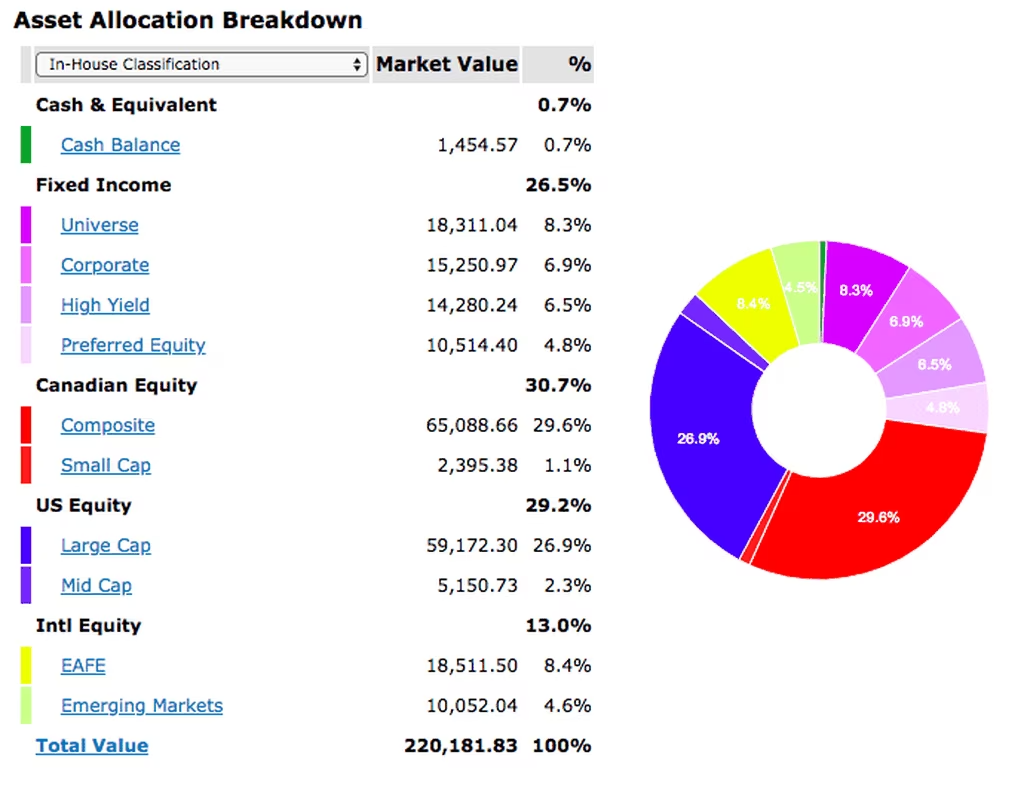

Justwealth is proud of saying that they are a financial company first and a tech platform second, and that is pretty obvious when you log into its client portal. It’s not as pretty as other robo-advisors in the FinTech world (who may classify themselves as more “tech” than “fin”) but it is clear and concise. The new client dashboard provides summaries for all accounts that the investor has with Justwealth. You can break your investment down by Account and Asset class, and each view aggregates all of the client accounts into one chart.

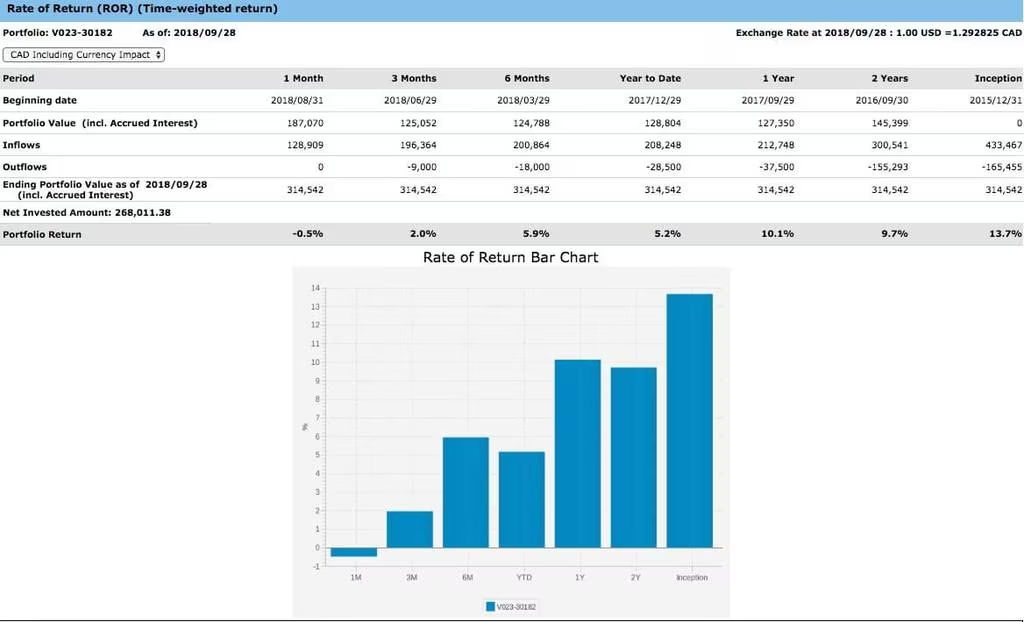

Justwealth also provides both time-weighted and money-weighted performance calculations, like the one you see below:

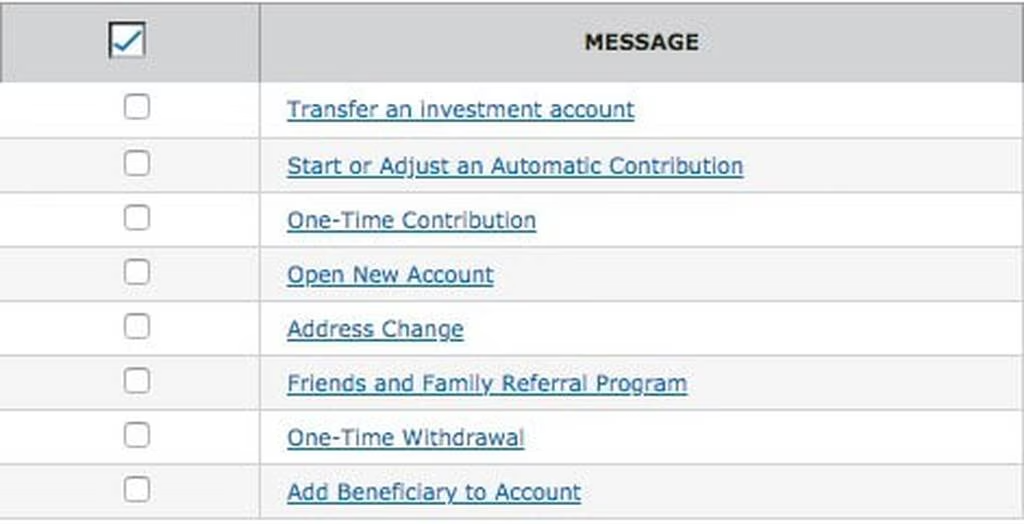

Finally, Justwealth’s Client Bulletin Board makes it easy to interact with Justwealth and make requests to transfer money, start or change automatic contributions, and open a new account.

The qualms with the design aside, obviously looks aren’t as important as how your portfolio performs, how low the fees are, and the quality of the advice Justwealth provides. Clearly, those areas are where Justwealth has put its focus.

Institutional investing can be done with Justwealth (Group RRSPs, corporate accounts and custom porfolios)

Justwealth has options for institutional investors too, including group RRSPs that allow employees to take advantage of Justwealth’s technology and low-cost ETF-based portfolios.

Justwealth also offers corporate accounts for corporate treasury and investment accounts. Corporate accounts are perfect for small and medium-sized companies looking to take advantage of taxable accounts but don’t want to DIY their investments.

Finally, Justwealth designs custom portfolios for not-for-profit organizations, helping them meet their investment obligations in a low-cost way. Justwealth has specific institutional asset allocation expertise to help not-for-profit organizations accomplish their investment objectives.

If we could change one thing

If we could change one thing about Justwealth, we’d change two. The first is the user experience. While Justwealth claims to put “Fin” first and “Tech” second, I think they should devote a little more time to the tech side of things. While their back end is serviceable, it’s not pretty to look at, and when you don’t have a brick-and-mortar branch to go to and you never meet your portfolio manager, the website user experience is the only representation of the company that is accessible to their users.

The second problem is the $5,000 minimum investment amount. While this is waived for students, new graduates, and RESP holders, for anyone looking to start investing who doesn’t fit into these categories, $5,000 is too steep. Some competing robo-advisors have much lower minimums or no minimums at all.

Comparing Justwealth to other brokerages

Justwealth vs. Wealthsimple

Justwealth provides more portfolio options and personalized service, while Wealthsimple excels in user experience and app design.

Justwealth and Wealthsimple differ significantly in their approach to fees and user experience. While both robo-advisors have similar management fees, ranging from 0.40% to 0.50%, Justwealth’s ETF management expense ratios (MERs) are slightly lower, averaging between 0.15% and 0.25%, compared to Wealthsimple’s higher average MERs.

However, Wealthsimple takes the lead in user experience and design, boasting a sleek, intuitive app and website that cater to tech-savvy investors. Justwealth, on the other hand, prioritizes comprehensive financial planning with dedicated portfolio managers and offers more portfolio options but lacks the modern, user-friendly interface that Wealthsimple provides.

Justwealth vs. Questrade

Justwealth and Questrade cater to different types of investors, with key differences in fees and investment options. Justwealth charges a straightforward management fee of 0.40% to 0.50%, which includes personalized portfolio management and tax-efficient strategies, making it ideal for hands-off investors.

In contrast, Questrade offers more flexibility with lower trading fees for DIY investors, allowing them to buy ETFs for free and trade stocks starting at $4.95 per trade. Additionally, Questrade provides options for self-directed investing, access to USD accounts for currency flexibility, and the ability to trade more complex securities like options and precious metals.

This makes Questrade better suited for investors looking for a more hands-on approach with a broader range of investment opportunities.

Justwealth vs. BMO SmartFolio

Justwealth and BMO SmartFolio both offer automated investing, but they differ in fees and the level of advisor expertise.

Justwealth charges slightly higher management fees of 0.40% to 0.50%, compared to BMO SmartFolio’s fees starting at 0.35% for smaller balances.

However, Justwealth stands out by providing each client with a dedicated, highly qualified portfolio manager who offers personalized financial planning, while BMO SmartFolio’s advisors may not have the same level of qualifications or fiduciary responsibility.

Choosing BMO SmartFolio can be convenient if you already bank with BMO, as it offers seamless integration with your banking accounts, making transfers and account management simpler. On the other hand, if you prioritize personalized advice and a more comprehensive approach to financial planning, Justwealth might be the better choice.

Is Justwealth safe?

- Justwealth is CIPF-insured, providing up to $1 million protection for each account type.

- It operates under strict fiduciary duties, ensuring client interests come first.

How to open a Justwealth account

Opening a Justwealth account is a cinch! You just need to have the right docs handy. To fully open an account and start growing your nest egg, you’ll need:

- Your social insurance number (SIN)

- Your beneficiary’s SIN (only for spousal RRSP accounts)

- Images of the front and back of a piece of government-issued photo ID

- An image of a recent bank account statement or screenshot from your online banking

- Your bank account information (a cheque is the easiest)

FAQ

Open a Justwealth account

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Best investing content

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.