Where is American Express accepted in Canada?

Chris and Hans / Shutterstock

Updated: December 13, 2024

American Express credit cards are consistently rated as some of the best credit cards in Canada. Still, despite this stellar reputation, these credit cards also have an unfair reputation of not being widely accepted across the country, which causes many Canadians to avoid them. So, where is American Express accepted in Canada?

American Express credit cards not being widely accepted is a common misconception.

The truth is that you can use American Express credit cards at thousands of merchants across Canada. Except for one or two that we’ll outline below, most retailers in Canada accept American Express credit cards. This availability, combined with the unique benefits of American Express credit cards, means you should think twice before ruling them out as a useful credit tool.

Canadian retailers that accept Amex credit cards

American Express has recently expanded its acceptance rate, and since, most major retailers accept American Express credit cards, including those listed below:

| Category | Example brands |

|---|---|

| Clothing | Aldo, Ardenne, H&M, Hudson’s Bar, Marshalls, Mark’s, Sport Chek, Sunglass Hut, Winner |

| Department stores (including online) | Canadian Tire, Amazon, Walmart |

| Dining | McDonald’s, Starbucks, Burger King, Oliver & Bonacini, Tim Hortons |

| Electronics | Apple, Best Buy, Canada Computers, Staples |

| Gas (including fuel) | Esso, Petro-Can, Shell, Ultramar, Irving Oil, Fast Gas Plus, Co-Op Gas Bars, Race Trac, Bluewave Energy |

| Groceries | Safeway, Sobeys, Metro, Metro Plus, Longos, Whole Foods Market, 7-Eleven, Circle K, Super C, Marché Richelieu, IGA, FreshCo |

| Hardware stores | The Home Depot |

| Home goods (including furnishings and décor) | Homesense, Hudson’s Bay, IKEA, Lowe’s, Marshall’s |

| Hotels | Fairmont Resorts & Hotels, Marriott, Hilton, IHG, Holiday Inn, Best Western, Radisson, Sheraton |

| Pharmacies (including drugstores) | London Drugs, Jean Coutu, Rexall, Uniprix, Uniprix Sante, Uniprix Clinique |

The lists above are just a small sampling of the thousands of retailers in Canada that accept American Express credit cards.

Canadian retailers that don’t accept Amex cards

While many Canadian retailers accept Amex cards, not all do. There are a few major retailers in Canada that don’t accept American Express credit cards. Some retailers don’t accept American Express because they have their own branded credit cards they’d prefer you to use. In addition, due to the higher fee Amex charges its retail partners (rather than Visa or Mastercard), many opt out of accepting an American Express credit card.

So, which brands won't let you pay with an Amex credit card? As of 2024, two major brands don't accept American Express:

- Costco

- Loblaws brands (excluding Shoppers Drug Mart)

Costco only accepts Mastercard (not even Visa), and their store credit card is a Mastercard. By only accepting Mastercard, Costco increases the likelihood that you’ll sign up for their branded credit card. Loblaws, with the exception of Shoppers Dug Mart and Costco, are excellent examples of large retailers that don’t accept American Express credit cards. Loblaws wants to get you into their PC financial credit cards.

Other than these retailers, you should be able to use your American Express credit card everywhere you shop.

Read more: Best Costco Credit Cards in Canada for 2024

Why get an American Express credit card?

American Express is consistently ranked as one of the top credit card providers in Canada, and one of the reasons they are so popular is the perks and rewards they offer their loyal cardmembers. Amex offers several excellent rewards credit cards that allow you to earn points on everyday purchases. You can redeem these points for free flights, hotels, or even merchandise and gift cards.

American Express offers a variety of rewards credit cards for different income levels and spending profiles, so no matter what your daily spending habits, there is a credit card that will suit your needs. Here are two high-earning Amex credit cards to consider.

American Express Cobalt® Card

4.9

up to 15k pts

Welcome offerFair

Suggested credit scoreEarn up to 15,000 Welcome Bonus Membership Rewards® points* – that’s up to $150 in value.

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Eligibility

Fair

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Fair

Required Annual Personal Income

$0

Required Annual Household Income

$0

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

the points on eligible eats & drinks purchases in Canada

5x

the points on eligible streaming subscriptions in Canada

3x

the points on eligible gas, transit & ride share in Canada

2x

the points on everything else

1x

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

1

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

$100 USD

21.99% - 30%

Variable APR Just some text

21.99% - 1%

Cash Advance APR 2

$155.88

Annual Fee 12.99/month

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Variable APR

21.99% - 30%

Cash Advance APR

21.99% - 1%

Annual Fee

$155.88

Foreign Transaction Fee

2.5%

Pros

-

High earn rates (up to 5% return on spending!)

-

Flexible month-by-month fee structure

-

Free supplementary cards

-

1:1 points transfer with selected hotels, airlines and frequent flyer programs

Cons

-

Accelerated earn rates only apply to purchases in Canada (not to purchases made abroad)

-

Amex has a more limited merchant acceptance rate than Visa and Mastercard

-

Slightly higher than average annual fee

Eligibility

Fair

Recommended Credit Score

$0

Required Annual Personal Income

$0

Required Annual Household Income

Recommended Credit Score

Fair

Required Annual Personal Income

$0

Required Annual Household Income

$0

5x

the points on eligible eats & drinks purchases in Canada

3x

the points on eligible streaming subscriptions in Canada

2x

the points on eligible gas, transit & ride share in Canada

1x

the points on everything else

1

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

$100 USD

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

the points on eligible eats & drinks purchases in Canada

5x

the points on eligible streaming subscriptions in Canada

3x

the points on eligible gas, transit & ride share in Canada

2x

the points on everything else

1x

additional Membership Rewards point for every $1 you charge on eligible hotel or car rental bookings made with American Express Travel

1

Get up to $100 USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room

$100 USD

21.99% - 30%

Variable APR Just some text

21.99% - 1%

Cash Advance APR 2

$155.88

Annual Fee 12.99/month

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Variable APR

21.99% - 30%

Cash Advance APR

21.99% - 1%

Annual Fee

$155.88

Foreign Transaction Fee

2.5%

The Cobalt Card is Money.ca's best credit card for 2024 thanks to its generous up to 5x points on eligible dining and groceries in Canada, bonus earn rates on streaming, gas, transit and rideshare purchases and 15,000 Membership Rewards® points* welcome bonus. Even better, the $155.88 annual fee is billed at $12.99/month, which can help make the card more affordable by using Amex MR points to pay that monthly fee.

Disclosures

Contact American Express for the most up-to-date referral bonus figures.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

The Platinum Card®

3.6

up to 140k pts

Welcome offerExcellent

Suggested credit scoreEarn up to 140,000 Membership Rewards® points* – that’s up to $1,400 in value.

Pros

-

Access to a wide range of luxury perks, including premium concierge service

-

Complimentary lounge membership providing access to over 1,400+ airport lounges worldwide

-

Annual statement credits: $200 annual travel credit, $200 annual dining credit

-

Special insurance coverages like trip cancellation/interruption, flight delay, lost or stolen baggage and rental car theft & damage.

-

Provides extended warranty (2 years) and purchase protection (120 days).

Cons

-

High annual fee of $799, one of the heftiest among Canadian cards

-

The rewards system can be complicated, especially for users not familiar with maximizing credit card points

-

Requires good to excellent credit for eligibility

Eligibility

Excellent

Recommended Credit Score

Recommended Credit Score

Excellent

2x

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

1x

point for every $1 in all other Card purchases

1

additional point on Amex Travel Online for eligible hotel or car rental bookings

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

2x

point for every $1 in all other Card purchases

1x

additional point on Amex Travel Online for eligible hotel or car rental bookings

1

21.99% - 28.99%

Variable APR Applies to your Flexible Payment Option balance. This charge card has both Due in Full and Flexible Payment Option balances.

$799

Annual Fee Supplementary Platinum Cards: $250 each

2.5%

Foreign Transaction Fee

Variable APR

21.99% - 28.99%

Annual Fee

$799

Foreign Transaction Fee

2.5%

Pros

-

Access to a wide range of luxury perks, including premium concierge service

-

Complimentary lounge membership providing access to over 1,400+ airport lounges worldwide

-

Annual statement credits: $200 annual travel credit, $200 annual dining credit

-

Special insurance coverages like trip cancellation/interruption, flight delay, lost or stolen baggage and rental car theft & damage.

-

Provides extended warranty (2 years) and purchase protection (120 days).

Cons

-

High annual fee of $799, one of the heftiest among Canadian cards

-

The rewards system can be complicated, especially for users not familiar with maximizing credit card points

-

Requires good to excellent credit for eligibility

Eligibility

Excellent

Recommended Credit Score

Recommended Credit Score

Excellent

2x

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

1x

point for every $1 in all other Card purchases

1

additional point on Amex Travel Online for eligible hotel or car rental bookings

points for every $1 in Card purchases on eligible dining and food delivery in Canada

2x

points for every $1 in Card purchases on eligible travel

2x

point for every $1 in all other Card purchases

1x

additional point on Amex Travel Online for eligible hotel or car rental bookings

1

21.99% - 28.99%

Variable APR Applies to your Flexible Payment Option balance. This charge card has both Due in Full and Flexible Payment Option balances.

$799

Annual Fee Supplementary Platinum Cards: $250 each

2.5%

Foreign Transaction Fee

Variable APR

21.99% - 28.99%

Annual Fee

$799

Foreign Transaction Fee

2.5%

The Platinum Card isn't your ordinary credit card. Instead, it's a charge card that offers a huge welcome bonus and plenty of impressive statement credits that more than make up for the steep $799 annual fee. The Platinum Card from American Express is a travellers dream thanks to its $100 NEXUS◊ statement credit, , unlimited access to Priority Pass and American Express Global Lounge Network lounges and huge welcome bonus - Earn up to 140,000 Membership Rewards® points* – that’s up to $1,400 in value.

Disclosures

- Contact American Express for the most up-to-date referral bonus figures.

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link. If you apply and get approved for an American Express Card, (I/we) may receive compensation from American Express, which can be in the form of monetary payment.

American Express insurance coverage can help you protect purchases (and more)

Many American Express credit cards offer a comprehensive suite of insurance coverage. Book your vacation with peace of mind knowing that American Express offers trip interruption and delay insurance, emergency medical insurance, and baggage loss and baggage delay insurance.

If you purchase merchandise such as electronics with your American Express credit card, you’ll likely qualify for purchase assurance, which insures your valuables against damage and theft for several months. Your purchase may also qualify for an extended warranty, which extends the manufacturer’s warranty up to one year.

Finally, if you rent a car, some American Express credit cards offer car rental collision and damage waivers, insuring your vehicle automatically so you don’t have to opt for expensive additional insurance.

Exclusive perks

American Express offers a variety of exclusive perks to their cardmembers, depending on which credit card you choose. If you enjoy attending exclusive concerts and events, the Front of the Line by American Express Invites will help you secure tickets to in-demand concerts, even if you miss early ticket sales.

If you travel frequently, some American Express credit cards offer great benefits at airports across the country. These benefits could include free airport lounge access, valet services, priority security line access to skip those long security lines, and priority check-in.

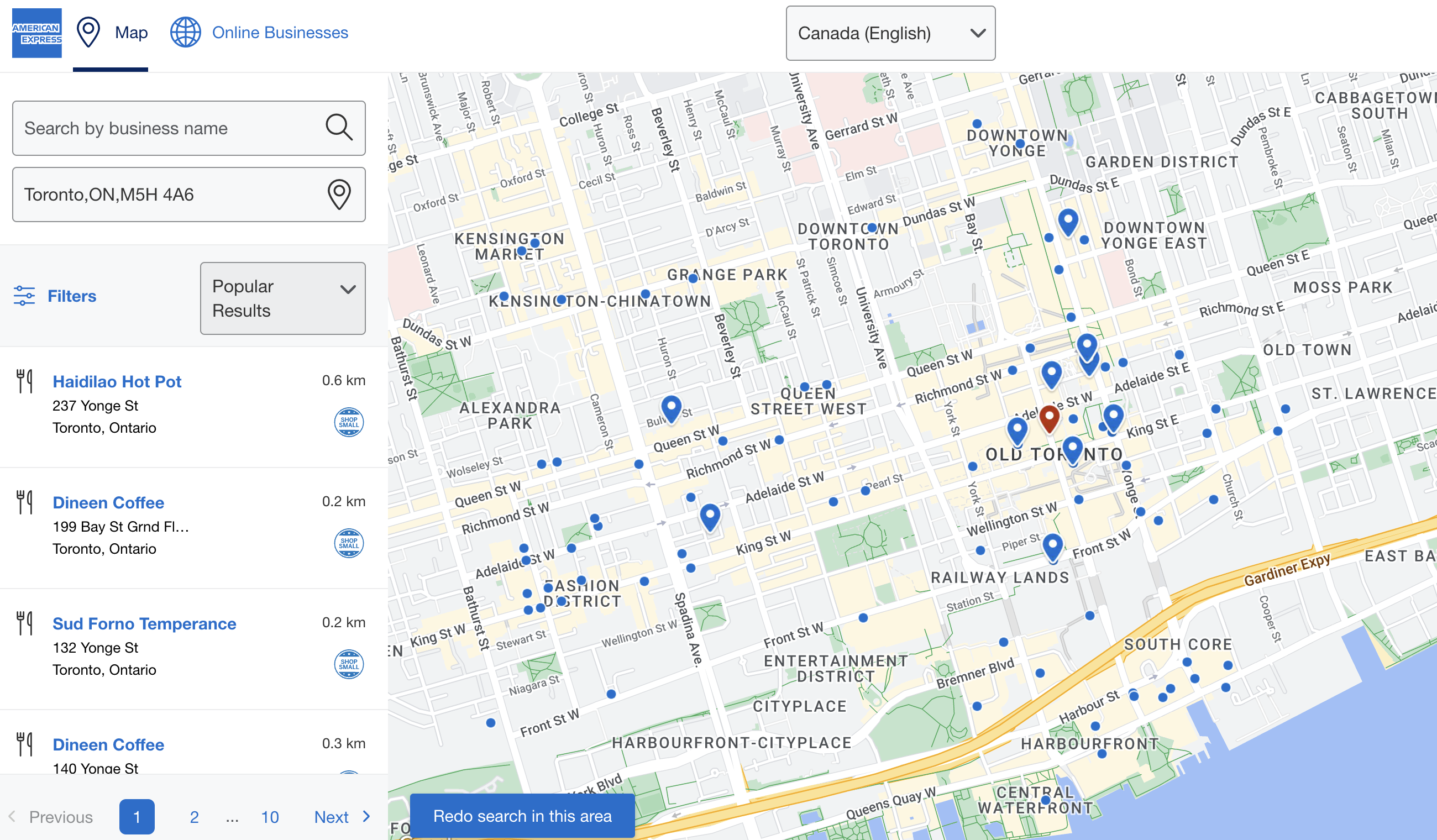

Using your American Express credit card to Shop Small® with local small businesses

While most major retailers in Canada accept American Express credit cards, not all small businesses do. American Express is committed to growing its network of small businesses that accept their credit cards, but there is still a chance you’ll find yourself at one of the few retailers that don’t.

Fortunately, you don’t have to avoid all mom-and-pop stores in your area. To help you determine whether a local retailer will accept your credit card, American Express has built a handy online map that is searchable by location – perfect for when you’re on the hunt for that perfect gift for a loved one.

What should I do if my Amex wasn’t accepted?

If you do run into a situation where you can’t use your American Express credit card, it’s a good idea to have a backup credit card in your wallet. If you’re an avid Costco shopper, a backup Mastercard may be a good idea to maximize your rewards earning at that major retailer.

No matter what the situation, if you find yourself in a position where you can’t use your credit card, American Express wants to know. They’ve created an easy-to-use feedback form to help determine where American Express credit cards are not accepted.

The bottom line

The reputation American Express credit cards have for being unusable with many retailers is mostly unfounded. Most major retailers accept American Express credit cards, and more and more local retailers are being added to their network every day, small businesses included.

For any shopping necessity, it’s definitely a great idea to have an Amex card fill one of your card slots in your wallet. Use your American Express card to get major bonuses and rewards during the biggest shopping season of the year.

Related articles:

American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.