CIBC Aventura rewards guide: Earn, redeem and fly sooner

Money.ca / Money.ca

Fact Checked: Amy Tokic

Updated: December 04, 2024

What is the CIBC Aventura Rewards program?

CIBC Aventura Rewards (also known as the CIBC Rewards program) is a travel rewards loyalty program offered by the Canadian Imperial Bank of Commerce (CIBC), that gives cardholders the chance to earn and redeem points for various perks, including travel-related benefits.

You earn Aventura Points, the program's currency, by using Aventura-branded credit cards for everyday purchases. Points can be redeemed for numerous travel rewards, including flights, hotels, car rentals and vacation packages. The program offers flexibility, allowing cardholders to book flights on any airline without blackout dates. Additionally, unlike some other loyalty travel rewards programs, you can use your Aventura Points to cover the entire cost of the airfare, including taxes and fees. Furthermore, Aventura points are not just for travelers, they can also be used for statement credits, donations to charity, financial products, gift cards and merchandise.

CIBC provides a range of personal and business Aventura credit cards, each with unique benefits and earning structures to cater to different spending habits. Picking the credit card that aligns with your spending is the best way to ensure you get the most from your Aventura points.

How to earn Aventura points fast

There are a couple of smart strategies to accumulate Aventura Points faster.

One of the most effective methods is to leverage the welcome bonuses offered by CIBC Aventura credit cards (note that not all of CIBC’s cards are Aventura cards so be sure to select a card linked to the rewards program).

These bonuses often provide a substantial number of points when cardholders meet specified spending requirements within the first few months of card ownership. This influx of points can be a significant boost to your Aventura balance, meaning you’ll earn flights and rewards faster.

The specific bonus you’ll earn and what you’ll need to spend to earn it will depend on the specific card you apply for. Also note that a good general rule of thumb is that the more premium the card, the bigger the bonus.

Keep in mind that while welcome bonuses are exciting and certainly accelerate earnings, they are a one-off way to earn a big point payoff. A better long-term strategy is to take advantage of higher earn rates with your credit card.

Different Aventura credit cards offer varying points-per-dollar ratios for different spending categories.

Choosing a card that aligns with your regular expenses, such as groceries, gas or travel, can result in more points earned for every purchase. By strategically using cards with elevated earn rates, you can optimize your point accumulation and thus get closer to your desired travel reward redemption.

CIBC Aventura® Visa* Card

3.8

up to 2,500 pts

Welcome offerGood

Suggested credit scoreEarn up to 2,500 Aventura Points† for no annual fee.

Pros

-

Easy to earn welcome bonus

-

Points can be earned on all purchases

-

Use Aventura Points to cover full airfare including taxes and fees

-

Can book with any airline with no blackout periods and points don’t expire†

Cons

-

Lower earn rate than some other travel cards on the market

Eligibility

Good

Recommended Credit Score

$15,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Household Income

$15,000†

1

point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on travel purchased through the CIBC Rewards Centre†

1

point for every $2 spent on all other purchases†

point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on travel purchased through the CIBC Rewards Centre†

1

point for every $2 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate 21.99 for Quebec residents†

22.99%†

Cash Advance APR 21.99 for Quebec residents†

$0

Annual Fee No annual fee

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$0

Foreign Transaction Fee

2.5%

Pros

-

Easy to earn welcome bonus

-

Points can be earned on all purchases

-

Use Aventura Points to cover full airfare including taxes and fees

-

Can book with any airline with no blackout periods and points don’t expire†

Cons

-

Lower earn rate than some other travel cards on the market

Eligibility

Good

Recommended Credit Score

$15,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Household Income

$15,000†

1

point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on travel purchased through the CIBC Rewards Centre†

1

point for every $2 spent on all other purchases†

point for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on travel purchased through the CIBC Rewards Centre†

1

point for every $2 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate 21.99 for Quebec residents†

22.99%†

Cash Advance APR 21.99 for Quebec residents†

$0

Annual Fee No annual fee

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$0

Foreign Transaction Fee

2.5%

This offer is not available for residents of Quebec.

†Terms and Conditions Apply

The information for the CIBC Aventura® Visa* Card has been collected independently by Money.ca. The card details on this page have not been reviewed or provided by the card issuer.

CIBC Aventura® Visa Infinite* Card

4.9

Up to $1,300 value†

Welcome offerGood

Suggested credit scoreJoin and get up to $1,300 in value including a first year annual fee rebate!†

Pros

-

First year annual fee rebate

-

High welcome bonus

-

Easy-to-use points redemption process

-

Nexus application fee rebate

-

Four complimentary lounge passes that can be used at 1,200+ airports

-

Mobile device and extended warranty insurance

Cons

-

Uninspired travel insurance offering

-

Difficult to earn points through daily spending

-

$139 annual fee that’s hard to justify

Eligibility

Good

Recommended Credit Score

$60,000†

Required Annual Personal Income

$100,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$60,000†

Required Annual Household Income

$100,000†

2

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate for non-Quebec residents†

22.99%†

Cash Advance APR for non-Quebec residents†

$139

Annual Fee First year annual fee rebate!† $50 up to 3 additional cards†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

Pros

-

First year annual fee rebate

-

High welcome bonus

-

Easy-to-use points redemption process

-

Nexus application fee rebate

-

Four complimentary lounge passes that can be used at 1,200+ airports

-

Mobile device and extended warranty insurance

Cons

-

Uninspired travel insurance offering

-

Difficult to earn points through daily spending

-

$139 annual fee that’s hard to justify

Eligibility

Good

Recommended Credit Score

$60,000†

Required Annual Personal Income

$100,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$60,000†

Required Annual Household Income

$100,000†

2

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

points for every $1 spent on travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate for non-Quebec residents†

22.99%†

Cash Advance APR for non-Quebec residents†

$139

Annual Fee First year annual fee rebate!† $50 up to 3 additional cards†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

This offer is not available for residents of Quebec.

†Terms and Conditions Apply

The information for the CIBC Aventura® Visa Infinite* Card has been collected independently by Money.ca . The card details on this page have not been reviewed or provided by the card issuer.

CIBC Aventura® Gold Visa* Card

4.9

up to $1,300

Welcome offerGood

Suggested credit scoreJoin and get up to $1,300 in value†! And get a one-time annual fee rebate.

Nearly identical to the CIBC Aventura Visa Infinite, but with a lower income requirement

Pros

-

High value welcome offer

-

Minimal household annual income required

-

Exceptional points-redeemable travel opportunities and other perks

Cons

-

High annual fee (rebated for your first year)†

Eligibility

Good

Recommended Credit Score

$15,000†

Required Annual Personal Income

$15,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$15,000†

Required Annual Household Income

$15,000†

2

Earn 2 points for every $1 spent on eligible travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

Earn 2 points for every $1 spent on eligible travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate 21.99% for Quebec residents†

22.99%†

Cash Advance APR 21.99% for Quebec residents†

$139

Annual Fee First year annual fee rebate!†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

Nearly identical to the CIBC Aventura Visa Infinite, but with a lower income requirement

Pros

-

High value welcome offer

-

Minimal household annual income required

-

Exceptional points-redeemable travel opportunities and other perks

Cons

-

High annual fee (rebated for your first year)†

Eligibility

Good

Recommended Credit Score

$15,000†

Required Annual Personal Income

$15,000†

Required Annual Household Income

Recommended Credit Score

Good

Required Annual Personal Income

$15,000†

Required Annual Household Income

$15,000†

2

Earn 2 points for every $1 spent on eligible travel purchased through the CIBC Rewards Centre†

1.5

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1

point for every $1 spent on all other purchases†

Earn 2 points for every $1 spent on eligible travel purchased through the CIBC Rewards Centre†

2

points for every $1 spent at eligible gas stations, EV charging, grocery stores and drug stores†

1.5

point for every $1 spent on all other purchases†

1

20.99%†

Purchase APR non-Quebec residents†

22.99%†

Balance Transfer Rate 21.99% for Quebec residents†

22.99%†

Cash Advance APR 21.99% for Quebec residents†

$139

Annual Fee First year annual fee rebate!†

2.5%

Foreign Transaction Fee 2.5% of the transaction in CDN

Purchase APR

20.99%†

Balance Transfer Rate

22.99%†

Cash Advance APR

22.99%†

Annual Fee

$139

Foreign Transaction Fee

2.5%

This offer is not available for residents of Quebec.

†Terms and Conditions Apply

The information for the CIBC Aventura® Gold Visa* Card has been collected independently by Money.ca. The card details on this page have not been reviewed or provided by the card issuer.

CIBC Aventura® Visa Infinite Privilege* Card

4.8

up to 80K pts

Welcome offerVery Good

Suggested credit scoreGet a total of up to 80,000 Aventura Points† (up to $1,600 in travel value) during your first year.

Pros

-

A welcome bonus of up to 80,000 Aventura Points†

-

Up to three points per dollar spent (two points for the most popular spending categories, though)

-

Six complimentary visits at over 1,200+ lounges per year through the Visa Airport Companion Program

-

$200 annual travel credit

-

Two NEXUS application fee rebates

-

Robust travel insurance, including emergency medical, trip cancellation, flight and baggage delay, auto rental collision and loss and more

Cons

-

Only available to those who make $150,000 per year as an individual or $200,000 as a household

-

High interest rates: 20.99% for purchases and 22.99% for cash advances

-

High fee of $499 per year

-

Despite this being a luxury travel card, you’ll have to pay foreign exchange fees

-

Have to spend $6,000 on the card within the first four months to unlock the maximum welcome bonus

Eligibility

Very Good

Recommended Credit Score

$150,000

Required Annual Personal Income

$200,000

Required Annual Household Income

Recommended Credit Score

Very Good

Required Annual Personal Income

$150,000

Required Annual Household Income

$200,000

3 points

for every $1 spent on travel purchased through CIBC Rewards Centre

2 points

for every $1 spent on eligible dining, entertainment, transportation, gas, electric vehicle charging, and groceries

1.25 points

for every $1 spent on all other purchases

6

complimentary visits at 1,200+ lounges globally through Visa Airport Companion Program

$200

annual Travel Credit

2

NEXUS Application Fee rebates

for every $1 spent on travel purchased through CIBC Rewards Centre

3 points

for every $1 spent on eligible dining, entertainment, transportation, gas, electric vehicle charging, and groceries

2 points

for every $1 spent on all other purchases

1.25 points

complimentary visits at 1,200+ lounges globally through Visa Airport Companion Program

6

annual Travel Credit

$200

NEXUS Application Fee rebates

2

20.99%

Purchase APR

22.99%

Balance Transfer Rate non-Quebec residents†

22.99%

Cash Advance APR non-Quebec residents†

$499

Annual Fee $99 for each additional card (up to 9)

2.5%

Foreign Transaction Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$499

Foreign Transaction Fee

2.5%

Pros

-

A welcome bonus of up to 80,000 Aventura Points†

-

Up to three points per dollar spent (two points for the most popular spending categories, though)

-

Six complimentary visits at over 1,200+ lounges per year through the Visa Airport Companion Program

-

$200 annual travel credit

-

Two NEXUS application fee rebates

-

Robust travel insurance, including emergency medical, trip cancellation, flight and baggage delay, auto rental collision and loss and more

Cons

-

Only available to those who make $150,000 per year as an individual or $200,000 as a household

-

High interest rates: 20.99% for purchases and 22.99% for cash advances

-

High fee of $499 per year

-

Despite this being a luxury travel card, you’ll have to pay foreign exchange fees

-

Have to spend $6,000 on the card within the first four months to unlock the maximum welcome bonus

Eligibility

Very Good

Recommended Credit Score

$150,000

Required Annual Personal Income

$200,000

Required Annual Household Income

Recommended Credit Score

Very Good

Required Annual Personal Income

$150,000

Required Annual Household Income

$200,000

3 points

for every $1 spent on travel purchased through CIBC Rewards Centre

2 points

for every $1 spent on eligible dining, entertainment, transportation, gas, electric vehicle charging, and groceries

1.25 points

for every $1 spent on all other purchases

6

complimentary visits at 1,200+ lounges globally through Visa Airport Companion Program

$200

annual Travel Credit

2

NEXUS Application Fee rebates

for every $1 spent on travel purchased through CIBC Rewards Centre

3 points

for every $1 spent on eligible dining, entertainment, transportation, gas, electric vehicle charging, and groceries

2 points

for every $1 spent on all other purchases

1.25 points

complimentary visits at 1,200+ lounges globally through Visa Airport Companion Program

6

annual Travel Credit

$200

NEXUS Application Fee rebates

2

20.99%

Purchase APR

22.99%

Balance Transfer Rate non-Quebec residents†

22.99%

Cash Advance APR non-Quebec residents†

$499

Annual Fee $99 for each additional card (up to 9)

2.5%

Foreign Transaction Fee

Purchase APR

20.99%

Balance Transfer Rate

22.99%

Cash Advance APR

22.99%

Annual Fee

$499

Foreign Transaction Fee

2.5%

†Terms and Conditions Apply

The information for the CIBC Aventura Visa Infinite Privilege card has been collected independently by Money.ca. The card details on this page have not been reviewed or provided by the card issuer.

How to redeem CIBC Aventura rewards

To redeem points, log in to your CIBC Aventura account on the CIBC Rewards Centre website or app, select the "Travel" tab and enter your travel details. The search results will display flights eligible for points redemption.

You’ll have the choice of going with either the Flex Travel option or the Flight Rewards (aka chart) option. It’s always wise to compare which of the two options gives you the most value for your points. While the chart will usually offer the best deal, it’s smart to spend a few minutes to compare.

When you’ve found the flight you like, just click “Continue” to be taken to the passenger information and payment site. This is where you'll be required to provide details for each passenger and complete the necessary payment information. Carefully review the flight details and the summary of costs, including taxes and fees.

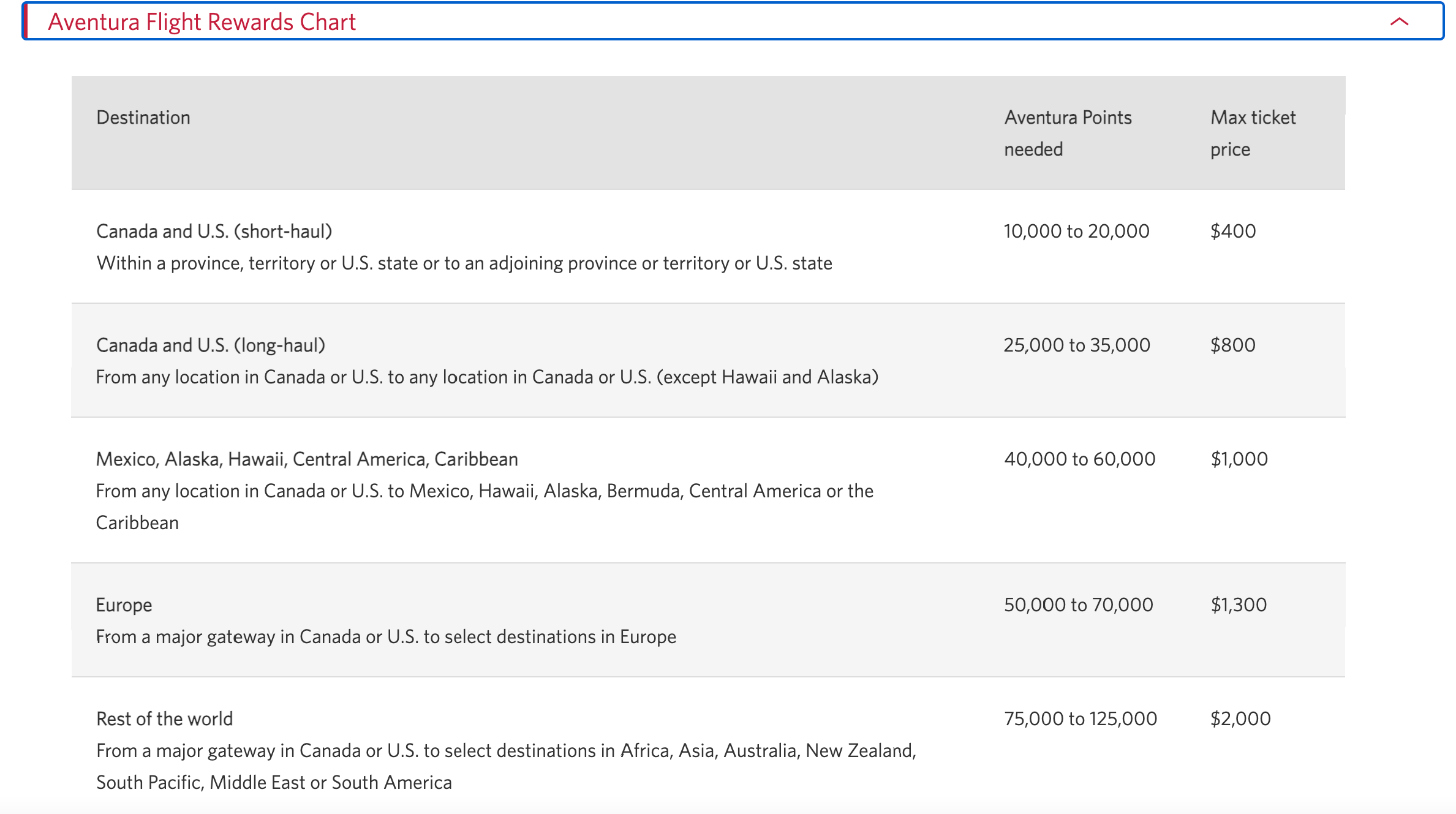

Why you want to use the CIBC Rewards Travel chart

While there are a variety of ways to redeem your Adventura points aside from travel — merchandise, gift cards and more — you’ll always get the best value when you redeem your points for travel. When redeemed for travel your points have a value of anywhere between 1 to 2.29. Whereas, outside of a promotion, you’ll only get an approximate value of .83 when you redeem points for statement credits or financial products or as low as .71 for gift cards and merchandise.

That being said, it’s important to note that, when redeeming for travel, your best bet is to go with the chart (the Flight Rewards option when you search) rather than just using your points to pay for a flight (called Flex Travel). Booking using the chart offers the best value and, depending on your flight, could get you a point value as high as 2.29 cents (and as low as 1.6) each whereas booking any flight at CIBC Rewards only gives you a max value of 1 cent per point.

Other ways to use your Aventura rewards

In addition to using your Aventura points for travel, there are several other ways you can redeem them for various benefits and financial products:

- 1.

CIBC financial products: Aventura points can be used toward a variety of CIBC financial products, including mortgage payments, Registered Retirement Savings Plans, Tax-Free Savings Accounts, Investor's Edge accounts, personal loans, lines of credit and even as statement credits on your CIBC credit card.

- 2.

Gift cards: You have the option to redeem your Aventura points for gift cards from a selection of retailers, like Amazon and Best Buy.

- 3.

Products: Aventura points can also be redeemed for a variety of products available through the rewards program. This might include electronics, merchandise or other items depending on the current offerings within the program.

CIBC Aventura travel insurance

There is no standard set of travel insurance that comes with a CIBC Aventura card. The type of CIBC Aventura travel insurance coverage you’ll receive will depend entirely on the card you go with. In general, the more premium the card, the more coverage you’ll get. For example, the CIBC Aventura Visa Infinite Card features hotel burglary insurance, whereas the CIBC Aventura Visa Card for Business does not. So it’s always important to read the fine print to see exactly what insurance your card comes with. With that in mind, the CIBC Aventura travel insurance that may come with your card includes: emergency travel medical insurance, flight delay and baggage insurance, trip cancellation and trip interruption insurance, auto rental insurance, $500,000 common carrier accident insurance, mobile device and hotel burglary insurance.

Aventura vs. TD Rewards

| Feature | CIBC Aventura | TD Rewards |

|---|---|---|

| Point value | .71 cents to as high as 2.29 cents when using the flight chart. | .25 cents up to as much as .5 cents when using Expedia for TD redemptions. This is a much lower point value than CIBC Aventura. Of course, keep in mind that a TD credit card with high earn rates could possibly make up for a lower point value. |

| Welcome offers | Aventura often features competitive welcome offers, with bonus points ranging from 2,500 to 80,000 or more. | TD Rewards also offers attractive welcome bonuses, ranging from 50,000 to 150,000 TD Rewards points. |

| Points expiry | Aventura points do not expire as long as the account remains open and in good standing. | TD Rewards points do not expire as long as the account is open and in good standing. |

| Points transferability | Aventura points can’t be transferred to other loyalty programs or airlines. | TD Rewards points are not transferable to other loyalty programs or airline partners. |

| Points for travel | You can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 cent up to 2.29 cents for travel. | Book travel with Expedia for TD or book travel through any provider and then redeem points to pay for the purchase. Travel points are valued at .04 to .05 cents. |

| Redemption flexibility | Flexible: Redeem points for travel, merchandise, gift cards, financial products, statement credits and more. | Flexible: Redeem points for travel, merchandise, gift cards, education, statement credits and more. |

Aventura vs. Aeroplan

| Features | CIBC Aventura | Aeroplan |

|---|---|---|

| Point value | Aventura points are valued at anywhere from .71 to 2.29 cents, depending on what you redeem them for. | Aeroplan points are valued at approximately 0.71 to 2 cents each, with the highest value when redeemed for flights. |

| Welcome offers | Aventura often features competitive welcome offers, with bonus points ranging from 2,500 to 80,000 or more. | Various Aeroplan credit cards offer widely different welcome bonuses because they are offered by financial institutions. American Express currently offers as much as a 90,000 bonus. |

| Points expiry | Aventura points don’t expire as long as the account remains open and in good standing. | Aeroplan points don't expire as long as there is account activity every 18 months. |

| Points transferability | Aventura points can’t be transferred to other loyalty programs or airlines. | Aeroplan has one of the best transfer programs among all loyalty programs in Canada. You can transfer Aeroplan points to American Express Membership Rewards and certain hotel rewards programs. |

| Points for travel | With Aventura you can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 cent up to 2.29 cents. | You can redeem Aeroplan points for flights, vacations, car rentals and more with Air Canada and partner airlines. Value per point ranges from .82 cents for hotels up to as high as 2 cents. |

| Redemption flexibility | Flexible: Redeem points for travel, merchandise, gift cards, financial products, statement credits and more. | Flexible: Redeem for flights, gift cards, car rentals, hotels and merchandise. |

Aventura vs. Scene+

| Feature | CIBC Aventura | Scene+ (Scotiabank) |

|---|---|---|

| Point value | Aventura points are valued at anywhere from .71 to 2.29 cents depending on what you redeem them for. | 1 cent for travel (as well as groceries, movies and more) to as low as 0.74 cents for gift cards. |

| Welcome offers | Aventura often features competitive welcome offers, with bonus points ranging from 2,500 to 80,000 or more. | A variety of credit cards come with up to 60,000 Scene+ points. |

| Points expiry | Aventura points don’t expire as long as the account remains open and in good standing. | Expire after 24 months of inactivity. |

| Points transferability | Aventura points cannot be transferred to other loyalty programs or airlines. | Points can’t be transferred to other loyalty programs. |

| Points for travel | With Aventura you can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 cent up to 2.29 cents. | Book flights, vacations, hotels and car rentals with Scene+ Travel, Powered by Expedia. Or redeem points for travel booked with any provider. Either way the value is 1 cent per point. |

| Redemption flexibility | Flexible: Redeem points for travel, merchandise, gift cards, financial products, statement credits and more. | Flexible: Redeem for movies, travel, statement credits, gift cards, donations, merchandise, groceries and more. |

Aventura vs. Avion

| Feature | CIBC Aventura | RBC Avion |

|---|---|---|

| Point value | Aventura points are valued at anywhere from .71 to 2.29 cents depending on what you redeem them for. | Avion points can net as much as much as 2.3 cents when using the Avion chart or as low as .58 cents for a statement credit. |

| Welcome offers | Aventura often features competitive welcome offers, with bonus points ranging from 2,500 to 80,000 or more. | Up to 35,000 Avion points. |

| Points expiry | Aventura points don’t expire as long as the account remains open and in good standing. | Never expire, as long as the account is in good standing. |

| Points transferability | Aventura points cannot be transferred to other loyalty programs or airlines. | Transfer points to WestJet, Cathay Pacific, British Airways and American Airlines. |

| Points for travel | With Aventura you can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 cent up to 2.29 cents. | Offers a special flight chart (Avion Grid) and the flexibility to redeem points for any travel expense. Value of 2.3 cents with grid or 1 cent for other travel. |

| Redemption flexibility | Flexible: Redeem points for travel, merchandise, gift cards, financial products, statement credits and more. | Flexible: Travel, merchandise, gift cards, RBC financial products, statement credits and charity. |

Aventura vs. AIR MILES

| Feature | CIBC Aventura | AIR MILES |

|---|---|---|

| Point value | Aventura points are valued at anywhere from .71 to 2.29 cents depending on what you redeem them for. | As high as 12.7 cents for rental cars, 10.5 cents for flights to as low as 9.5 cents for merchandise. |

| Welcome offers | Aventura often features competitive welcome offers, with bonus points ranging from 2,500 to 80,000 or more. | BMO offers AIR MILES credit cards with bonuses as high as 3,000 AIR MILES. |

| Points expiry | Aventura points don't expire as long as the account remains open and in good standing. | Miles expire after 24 months of inactivity. |

| Points transferability | Aventura points can’t be transferred to other loyalty programs or airlines. | No. |

| Points for travel | You can use a travel chart or just use your points toward any flight you choose. You can redeem for a range of travel expenses, like flights, hotels and car rentals. Value from 1 cent up to 2.29 cents. | You can book travel with any partner you want on the AIR MILES website. Values range from 12.7 cents for rental cars to 9.8 cents for hotels. |

| Redemption flexibility | Flexible: Redeem points for travel, merchandise, gift cards, financial products, statement credits and more. | Flexible: Two types of miles (Dream Miles and Cash Miles) with redemption options, including travel, merchandise and cash rewards |

FAQs

Sandra MacGregor has been writing about finance and travel for nearly a decade. Her work has appeared in a variety of publications like the New York Times, the UK Telegraph, the Washington Post, Forbes.com and the Toronto Star.

More great credit card content

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.